Book a session now and let’s begin building the best structure on your success. Greatest fitted to companies with two or more Company Registration in the UAE: Main Steps Every Business Must Follow lively partners, allowing shared ownership and duties. Best for managing multiple entities, defending assets, and centralising control across a group structure. 📘 70+ Profitable Enterprise Ideas in Dubai (2026)High-demand alternatives for entrepreneurs, expats & investors. 📘 UAE Enterprise Exercise Choice CheatsheetChoose the right exercise and remain compliant.

- We help design a capital construction that supports current needs while attracting future funding.

- Opening a checking account in a international jurisdiction can be a complicated process due to various requirements and rules.

- One Other key dimension of future-proofing lies in digital compliance and data administration.

- Pearl Lemon Authorized delivers skilled authorized solutions to individuals and companies.

Kpmg Insight

We supply steady advisory providers that will help you modify and adapt to changing enterprise circumstances, ensuring your construction stays optimal as your business evolves. Setting up the right authorized entity is the foundation of a successful enterprise. Whether you’re looking to establish a Free Zone firm, a Restricted Legal Responsibility Firm (LLC), or a branch of a foreign company, we allow you to navigate the complexities of enterprise formation in the UAE. Whether you’re navigating corporate tax, possession disclosures, or cross-border structuring, we hold you compliant and ahead of the curve.

Understanding 100% overseas possession under 2021 reforms which sectors and jurisdictions enable it. Partner with Hexagon Advisory at present and transform your small business structure right into a mannequin of energy, efficiency, and growth. From preliminary session to post-implementation assist, we provide end-to-end providers, ensuring your transition is clean and profitable. We ensure all structural modifications comply with UAE regulations, including necessary reporting, filings, and approvals. We analyze your present structure, objectives, and challenges to determine the most effective restructuring or new construction for your small business.

Adapt To Changing Market Circumstances

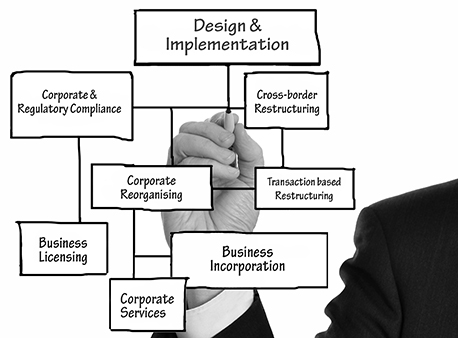

Well Timed guidance from a team of seasoned monetary, legal, and enterprise consultants is crucial to constructing your profitable enterprise. The company structure of an organization is a distinguished issue in the foundation of a profitable enterprise. Getting yourself an advisory supplier that can help you with all-inclusive company structuring providers is widely useful within the dynamic enterprise sector of the UAE. Discovering the optimum setup for any firm may only be discovered after thorough research and perception analysis. Our corporate restructuring providers in Dubai help companies reorganize operations to maximise effectivity and profitability.

Strategic Planning And Suggestion

We supply complete company providers solutions designed to assist companies in navigating this essential aspect with precision. With extensive expertise in company advisory and restructuring, Hexagon Advisory supplies specialised solutions designed to satisfy both local and international enterprise requirements. Our professionals analyze your company’s present framework — from ownership patterns to financial flow — to identify opportunities for efficiency and compliance improvement.

Varied requirements, including company hierarchy restructuring, asset acquisition, capital attainment, and more, could probably be made easy with our advisory and companies company structure. Effective structuring and restructuring of your small business within the dynamic financial system of Dubai and UAE generally is essential. At ADAM Global, we’re dedicated to delivering professional corporate structuring and restructuring companies which are finely tuned to the unique wants of enterprises operating on this vibrant market. To profit from the 0% corporate tax rate, entities should meet stringent qualifying income standards, comply with ESR, and keep away from disqualifying transactions with mainland or non-qualifying entities. Failure to satisfy these situations could end in reclassification as a taxable entity underneath the final 9% regime. Free zone companies should therefore revisit their operational fashions, contracts, and related-party preparations to make sure they remain aligned with the evolving tax landscape.

Leave a Reply